Written by : Chris Lyle

Dec 17, 2025

Estimated reading time: 15 minutes

Key Takeaways

Litigation funding intake AI automates and optimizes lawsuit financing lead screening, improving speed, accuracy, and fairness.

AI tools use advanced machine learning and NLP to analyze case data, predict outcomes, and recommend funding decisions.

Transitioning from manual to automated lead screening removes human bias, reduces labor costs, and enhances scalability.

Legal case funding pre-qualification AI platforms integrate seamlessly with existing workflows and provide dynamic, data-driven scoring.

AI-driven screening enables higher funding approval rates, faster intake, and improved ROI for law firms and funders.

Implementing AI solutions requires careful selection, compliance adherence, and ongoing staff training for maximum benefit.

Table of Contents

Introduction: Litigation Funding Intake AI and the Evolution of Lawsuit Financing Lead Screening

Understanding Litigation Funding and the Need for Lawsuit Financing Lead Screening

The Role of Litigation Funding Intake AI in Modern Legal Funding

Features of Legal Case Funding Pre-Qualification AI Tools

Advantages of AI-Driven Lawsuit Financing Lead Screening

Implementation Considerations for Litigation Funding Intake AI

Case Studies and Real-World Use Cases

Conclusion: The Future of Lawsuit Financing Lead Screening with Litigation Funding Intake AI

FAQ

Introduction: Litigation Funding Intake AI and the Evolution of Lawsuit Financing Lead Screening

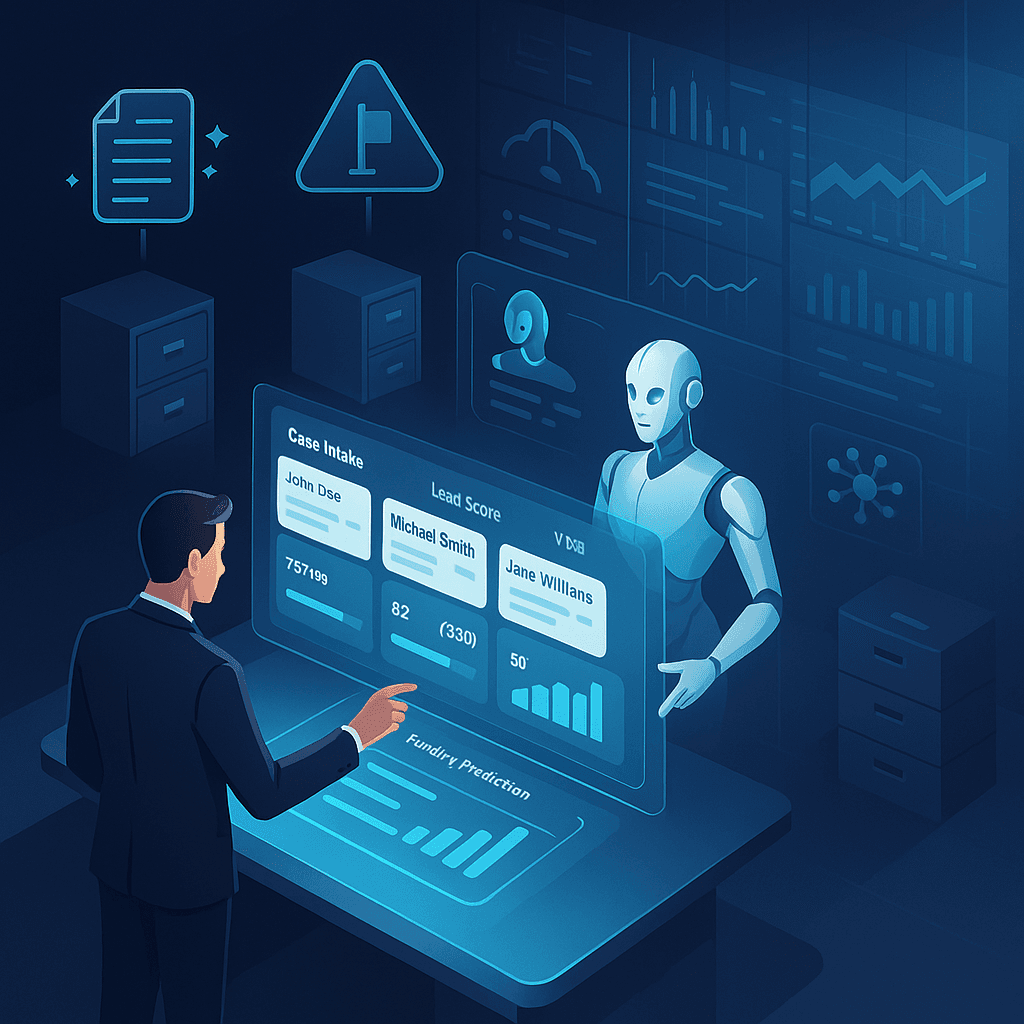

Litigation funding intake AI is rapidly redefining the way law firms and legal financiers approach lawsuit financing lead screening. This class of AI-driven tools is built to automate and optimize the initial intake, qualification, and triage of leads for third-party litigation funding.

At its core, litigation funding intake AI utilizes advanced machine learning https://golawhustle.com/blogs/ai-for-lawyers—sifting through case documents, court records, and historical outcomes—to:

Predict the likelihood of case success

Analyze funding viability

Recommend next steps based on statistical risk/reward

The growing importance of AI in this domain reflects a stark reality: today’s law firms face escalating volumes of funding inquiries and an intensely competitive legal finance landscape. Manual screening of lawsuit leads is slow, expensive, and susceptible to human error and bias. Traditional review methods struggle with inconsistent evaluations, delays, and a high risk of overlooking valuable (or risky) case details.

Manual screening pitfalls:

Delays in lead handling

High operational and labor costs

Subjectivity and inconsistency in evaluations

By contrast, AI-powered lawsuit loan intake solutions https://golawhustle.com/blogs/ai-tools-for-law-firms bring major advantages. Using machine learning and automated document analysis, these platforms rapidly process historical data, spot patterns that humans may miss, and flag high-potential leads for fast-tracked review. The result: higher-quality intakes handled at much greater speed and reduced cost.

Key benefits of litigation funding intake AI:

Streamlines intake process through automation

Reduces subjective human involvement

Surfaces high-probability, profitable leads for funders

Frees up legal staff for more strategic work

Law firms that adopt AI for their lawsuit financing lead screening gain an immediate edge—scaling their operations, increasing both the efficiency and fairness of lead assessments, and capturing more opportunities in an ever-tighter financial environment.

Research Links:

Sentry Group

Winston & Strawn LLP

Filevine

Eve.Legal

Understanding Litigation Funding and the Need for Lawsuit Financing Lead Screening

The Basics of Lawsuit Financing and Why Lead Screening Matters

Keyword: lawsuit financing lead screening

What is litigation funding?

Litigation funding (legal finance) refers to the provision of capital by third-party investors to claimants or law firms engaged in legal disputes. In exchange, the funder receives a share of any resulting settlement or judgment. This financial arrangement allows plaintiffs and firms to pursue meritorious cases without absorbing the legal costs and risks up front.

Why is lawsuit financing lead screening critical?

Qualification is vital: Funders only profit when a case results in a successful resolution.

Accurate screening ensures only high-potential, viable cases receive funding, maximizing ROI and minimizing losses.

Traditional lead screening pain points:

Manual, labor-intensive review of voluminous case records and legal documents.

Subjectivity and inconsistency: Human evaluators bring bias and varied standards.

Time and cost: Reviews are slow, causing deals to be missed or delayed.

Lost opportunity/risk: Strong or risky cases may be mishandled due to overlooked details.

Why transition to automation with a legal funding qualification bot?

- To standardize and streamline the intake process. - To process more leads with data-driven objectivity and speed. - To scale lead handling capabilities as the volume of financing requests grows.

Key insight:

AI tools driven by robust algorithms deliver rapid, data-backed insights—flagging the most promising cases for follow-up, while reducing resource allocation for weaker or out-of-scope leads.

Research Links:

Sentry Group

Burford Capital

Winston & Strawn LLP

Filevine

The Role of Litigation Funding Intake AI in Modern Legal Funding

How Litigation Funding Intake AI Surpasses Manual Lead Screening

Keyword: litigation funding intake AI

How does litigation funding intake AI work?

Advanced machine learning models ingest and process large quantities of relevant case data: legal filings, court dockets, prior outcomes, financial statements, and more. https://golawhustle.com/blogs/ai-powered-lead-generation

The AI predicts success probabilities, weighs risks, forecasts settlement odds, and provides recommendations for funding or rejection.

NLP (Natural Language Processing) extracts key details and arguments from case narratives, pulling relevant data from structured and unstructured sources.

AI lawsuit loan intake system workflow:

Automated intake: Clients upload case documents or fill out tailored forms.

NLP parsing: AI scans for legal arguments and factual claims.

Records integration: Instantly cross-checks with existing court databases and public records.

Rapid assessment: Generates a concise, data-rich portfolio for funder review.

Why is AI more effective than human reviewers?

Speed: AI reviews documents and data in minutes, not days or weeks.

Accuracy: Data-driven, unbiased processing ensures higher precision.

Scalability: Handles hundreds or thousands of leads with minimal incremental resource use.

Consistency: Every lead is screened using a uniform, repeatable process.

Example: Sentry Group & HyperScience

Partnership illustrates how automated document ingestion and criteria checks can drastically lighten manual workloads, allowing scarce legal expertise to be spent only where most valuable.

Research Links:

Sentry Group

Winston & Strawn LLP

Features of Legal Case Funding Pre-Qualification AI Tools

What Makes Legal Case Funding Pre-Qualification AI and Bots Effective?

Keyword: legal case funding pre-qualification AI

Modern legal case funding pre-qualification AI platforms deliver a suite of features that optimize the process from initial intake to the go/no-go funding decision.

Core Evaluation Features

Multi-factor analysis: Considers court, judge, case type, legal strategy, as well as the track record for similar cases.

Historical benchmarking: Compares outcomes, settlement rates, and damages awarded in comparable precedents.

Dynamic eligibility scoring: Each lead’s data is run against the funder’s unique funding criteria to provide a probability-weighted decision suggestion.

Risk profile generation: Flags key risk factors—from defendant solvency to plaintiff credibility.

Legal Funding Qualification Bot Capabilities

Algorithmic case mining: Proprietary algorithms (like Legalist’s “truffle sniffer”) automatically scan dockets and public documents to surface high-value prospects. https://golawhustle.com/blogs/legal-ai-solutions

Criteria-based decision trees: Factors such as merit, likelihood of payout, and risk of non-collection drive internal scoring and prioritization.

Ongoing workflow integration: The bot pulls new data as cases progress, refines scores, and adapts to changes in law firm or funder strategy.

Human-in-the-loop models: Exceptional or borderline cases are flagged for attorney review, ensuring critical judgment is retained for edge scenarios.

Seamless Law Firm Workflow Integration

Automatic data pulls from firm management systems, CRM, or external legal databases.

APIs and plug-ins for easy integration into existing case management software.

Tailored notifications/dashboarding for instant visibility into intake pipeline health and flagged opportunities.

Utilizing these features, law firms and funders gain a repeatable, scalable, and auditable qualification process—removing as much subjectivity and guesswork as possible.

Research Links:

Winston & Strawn LLP

Sentry Group

Filevine

Advantages of AI-Driven Lawsuit Financing Lead Screening

Why AI Lawsuit Loan Intake and Bots are Game-Changers for Lawsuit Financing Lead Screening

Keyword: lawsuit financing lead screening

The transition to AI-centered screening models brings quantifiable, transformative benefits.

Key Benefits:

Accuracy and Consistency

AI identifies patterns and correlations across thousands of cases, leading to fair, reproducible screening standards.

Reduces human bias and emotion-driven inconsistencies.

Speed and Turnaround

What once took days or weeks can now be handled in minutes or hours.

Competitive funding decisions can be made before other firms respond, increasing win rates for sought-after cases.

High-Potential Case Prioritization

Predictive analytics flag leads with the highest statistical likelihood of successful outcomes or settlement.

AI can quickly deprioritize leads with low funding potential, making the workflow leaner.

Cost Savings and Operational Efficiency

Cuts staff hours spent on manual screening and reduces need for extensive onboarding training.

Example: Filevine’s LeadsAI reports 25% cuts in training costs and annual savings of $5,500 per model firm.

Revenue and ROI Growth

By reducing cycle time and increasing win rates, AI-driven lead screening directly boosts funder and firm revenues.

Table: Manual vs. AI-Driven Lawsuit Lead Screening

Feature | Manual | AI-Driven |

|---|---|---|

Review Speed | Slow | Instant/Real-Time |

Consistency | Variable | High |

Bias Level | Significant | Very Low |

Scalability | Poor | Excellent |

Cost | High | Substantially Reduced |

Transparency | Depends | Full Audit Trail |

Research Links:

Sentry Group

Winston & Strawn LLP

Filevine

Implementation Considerations for Litigation Funding Intake AI

Selecting and Rolling Out Litigation Funding Intake AI and Related Tools

Keyword: litigation funding intake AI

Moving to an AI-powered system isn’t plug and play. Firms must evaluate, deploy, and optimize their solutions for maximum impact.

1. Solution Selection

Predictive accuracy: Assess the model’s performance metrics based on relevant case data and funder criteria.

Seamless integration: Ensure the AI solution fits with existing case management and intake workflows.

Customization: Look for the ability to tailor scoring models and workflows to firm or funder-specific needs.

Vendor credibility: Consider providers with proven experience (e.g., Sentry Group’s partnership with HyperScience).

2. Data Privacy and Regulatory Compliance

Privacy features: The AI platform must comply with GDPR and other data protection laws.

Human oversight: Maintain “human-in-the-loop” exceptions for compliance, transparency, and ethical decision-making.

Audit trails: Ensure every decision and screen is fully logged for regulatory review.

3. Staff Training and Onboarding

Interpretation training: Teach staff how to read and action AI scorecards and exception flags.

User-friendly dashboards: Select solutions with visual, intuitive reporting interfaces.

Training modules: Implement initial and ongoing training to keep staff and attorneys up to date as models or workflows evolve.

LSI/Related Terms: automation, compliance, risk management, audit, workflow integration

Research Links:

Sentry Group

Winston & Strawn LLP

Filevine

Case Studies and Real-World Use Cases

Litigation Funding Intake AI in Action: Sentry Group, Legalist, and Filevine

Keyword: litigation funding intake AI

Sentry Group: Automating Document Review and Funding Criteria Checks

Challenge: High volume of case documents for funding intake; manual screening too slow to scale.

Solution: Integration of AI with HyperScience to ingest, analyze, and align incoming documents to funding criteria.

Results: Dramatic reduction in manual workload. Staff spends time only on flagged exceptions, boosting efficiency and accuracy.

Legalist: "Truffle Sniffer" Algorithm for Case Discovery

Challenge: Identifying profitable cases from vast court dockets nationwide.

Solution: Proprietary algorithm scans court records for ideal case variables (court, judge, outcomes, defendant solvency) with virtually zero manual input.

Results: Funders focus resources on highest-yield opportunities, reducing labor but increasing funding success rates.

Filevine’s LeadsAI: Lead Handling at Scale

Challenge: Slow, costly legal intake hampered by staffing/training needs.

Solution: LeadsAI automates intake workflows, screening and triaging new leads with predictive analytics.

Results: Reduced training costs by 25%, annual savings of $5,500 per firm, faster lead turnaround, and higher revenue.

Measurable Outcomes

Higher funding approval rates: Thanks to precise, data-driven lead identification.

Intake efficiency gains: Far more leads processed per staff hour.

Superior case prioritization: Strongest cases surfaced automatically for fastest follow-up.

Research Links:

Sentry Group

Winston & Strawn LLP

Filevine

Conclusion: The Future of Lawsuit Financing Lead Screening with Litigation Funding Intake AI

Keyword focus: litigation funding intake AI, lawsuit financing lead screening, legal funding qualification bot, legal case funding pre-qualification AI, AI lawsuit loan intake

Law firms and legal finance providers who embrace litigation funding intake AI stand to gain substantial improvements in lawsuit financing lead screening. By leveraging predictive analytics, AI-driven document review, and legal funding qualification bots, they can:

Vastly improve screening precision for case selection

Slash operational costs and staff time

Mitigate high-stakes risk in lawsuit funding decisions

Win more business by capitalizing on faster, superior intake processes

The risk of manual, subjective screening is simply no longer acceptable for firms seeking growth and competitive advantage in the booming legal finance sector. AI lawsuit loan intake, legal case funding pre-qualification AI, and similar solutions are no longer optional—they’re necessary tools for survival and leadership.

What should your next step be?

Evaluate and pilot leading litigation funding intake AI platforms to see firsthand the impact on your bottom line. These tools deliver proven benefits in lead quality, efficiency, and cost savings—empowering your firm to scale, compete, and succeed in the new era of legal finance.

Ready to see how AI-driven lawsuit lead intake can work for your law firm?

Book a demo of LawHustle today

References / Research Sources

Sentry Group – Using Artificial Intelligence in Litigation Funding

Eve.Legal – How AI Can Transform Plaintiff Law Firm Intake Processes

FAQ

What is litigation funding intake AI?

Litigation funding intake AI is a category of AI-driven tools that automate and optimize the initial screening, qualification, and triage of leads for lawsuit financing. It uses machine learning and NLP to analyze case data and predict funding viability.

How does AI improve lawsuit financing lead screening?

AI increases speed, accuracy, and scalability of lead screening by processing large volumes of data rapidly, applying consistent criteria, reducing human bias, and flagging high-potential cases for funding decisions.

What are the key benefits of using AI in litigation funding?

Benefits include streamlined and automated intake, reduced subjectivity, faster turnaround times, higher quality lead prioritization, operational cost savings, and improved ROI.

How can law firms implement litigation funding AI tools effectively?

Firms should carefully select solutions based on predictive accuracy and integration capabilities, ensure compliance with privacy regulations, maintain human oversight, and invest in staff training and onboarding to leverage AI benefits.

Are there real-world examples of AI in litigation funding?

Yes. Examples include Sentry Group using AI with HyperScience for document review, Legalist’s “truffle sniffer” algorithm for case discovery, and Filevine’s LeadsAI automating intake workflows to boost efficiency and revenue.